Despite a sharp rise in home prices in 2020

and impacts from the pandemic-induced lockdown restrictions, the country’s

housing risk remains "moderate.”

That’s according to the third-quarter Housing

Market Assessment published by the Canada Mortgage and Housing Corporation

(CMHC).

"In contrast with the second quarter of 2020,

where the initial impact of the COVID-19 crisis was felt most acutely, housing

market activity across the country increased significantly in the third

quarter,” CMHC noted.

But while home sales rebounded as the year

progressed, new listings coming onto the market didn’t keep pace, which caused

inventory levels to hit a record low, which in turn drove prices higher across

the country "beyond what could be supported by fundamental factors.”

"This led to an increase in the number of

Census Metropolitan Areas (CMAs) exhibiting either a moderate or high degree of

vulnerability in the third quarter,” the housing agency added.

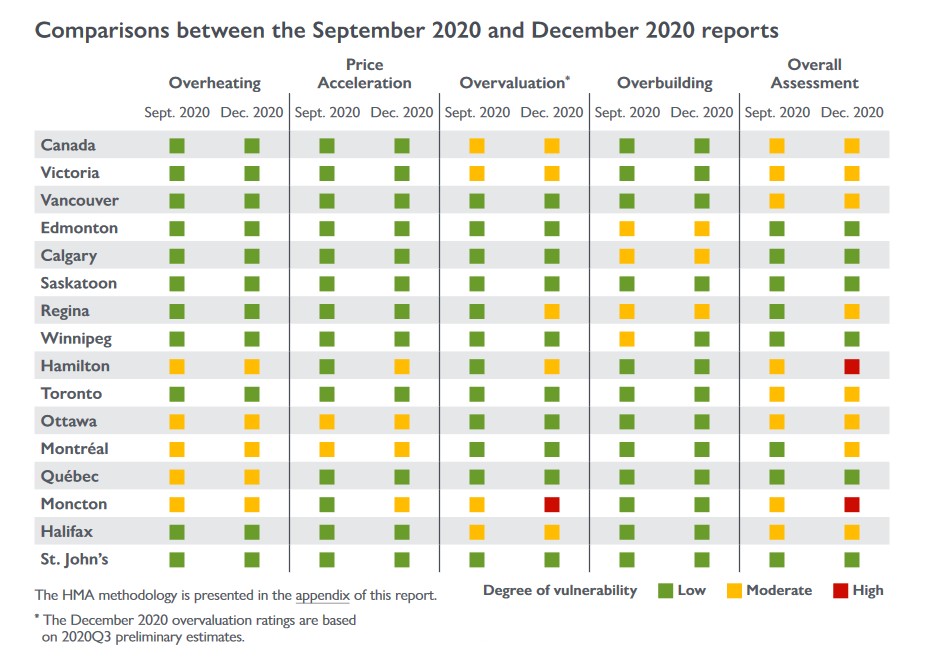

Hamilton and Moncton were the only two CMAs

tracked by CMHC to receive a high overall risk assessment in the third quarter.

Seven of the 15 CMAs received a moderate rating.

(Courtesy: CMHC)

CMHC’s evaluation looks at four risk

categories: overheating, price acceleration, overbuilding and overvaluation.

In terms of overvaluation, Victoria,

Regina, Hamilton and Halifax are considered moderate risk, while Moncton

received a high-risk rating. At the national level, CMHC noted that "observed

house price growth in the third quarter significantly outpaced growth in the

fundamental price, resulting in a widening of the overvaluation gap.”

Overvaluation in the national housing

market peaked in 2016-17 before falling back to a balanced level by the end of

2019.

Markets with a low overall vulnerability

were mostly confined to the harder-hit resource-based housing markets in the Prairie

provinces and Atlantic Canada, where prices have remained weak for several

years. They include Edmonton, Calgary, Saskatoon, Winnipeg and St John’s.

What are the Ramifications?

As prices continue to increase,

particularly in the country’s large urban centres, we’re seeing more evidence of

people leaving the cities to more affordable markets in the surrounding areas—a

trend that first began soon after the initial lockdown restrictions last

spring.

New datafrom Statistics Canada shows both Toronto and Montreal experienced record-high

population losses to its surrounding areas between July 2019 and July 2020. Toronto

saw a net loss of more than 50,000 people during that time, while Montreal saw a

net loss of about 25,000 people.

"In Toronto,

the net loss was mainly driven by people moving to surrounding CMAs,” StatsCan

noted.

Meanwhile, more than a third of Canadians

(38%) who plan on buying a home in the next two years say they plan on looking at

properties in the suburbs or a commuter city. That’s according to a surveyby RBC.

There may be one bright spot for those

waiting to enter the market -- there are signs the price growth is already

relenting and will slow further this year, according to economists from

National Bank. That observation was made in the latestTeranet-National Bank House Price Index, an aggregate price index of Canada’s

largest 11 real estate markets.

"The unsmoothed composite index, seasonally

adjusted, was up 0.8% in November – a cooling from the rises of the previous

three months,” the economists wrote,” suggesting that the uptrend of the

published (smoothed) index could slow in coming months.”

Regardless of what happens with house

prices, , a majority of Canadians continue to see the benefit and value of

homeownership, with 80% saying buying a home is a good investment.

"Many Canadians continue to be

financially resilient in the face of the pandemic, and this has carried over

into the real estate market,” said RBC’s Amit Sahasrabudhe, VP, Home Equity

Financing, Products and Acquisitions.

"Seen as a pillar of stability,

Canadians continue to view homeownership as a worthwhile pursuit and are

willing to shift their priorities in order to find affordable property within

their budget."